Table Of Content

- Cheapest California homeowners insurance if you have a high-deductible policy

- Full list of best homeowners insurance in California

- Best homeowners insurance in California for consumer experience: Nationwide

- Cheapest Homeowners Insurance Based on Dwelling Coverage

- How much is homeowners insurance in California?

Actual cash value policies reimburse you based on the value of the item at the time of loss, factoring in depreciation. So, if that same couch is lost in a fire and you have an ACV policy, you may receive a substantially lower settlement that reflects the value of the used couch. FEMA’s Individuals and Households Program (IHP) can provide financial and direct assistance after a major disaster or emergency, if you’re eligible.

Cheapest California homeowners insurance if you have a high-deductible policy

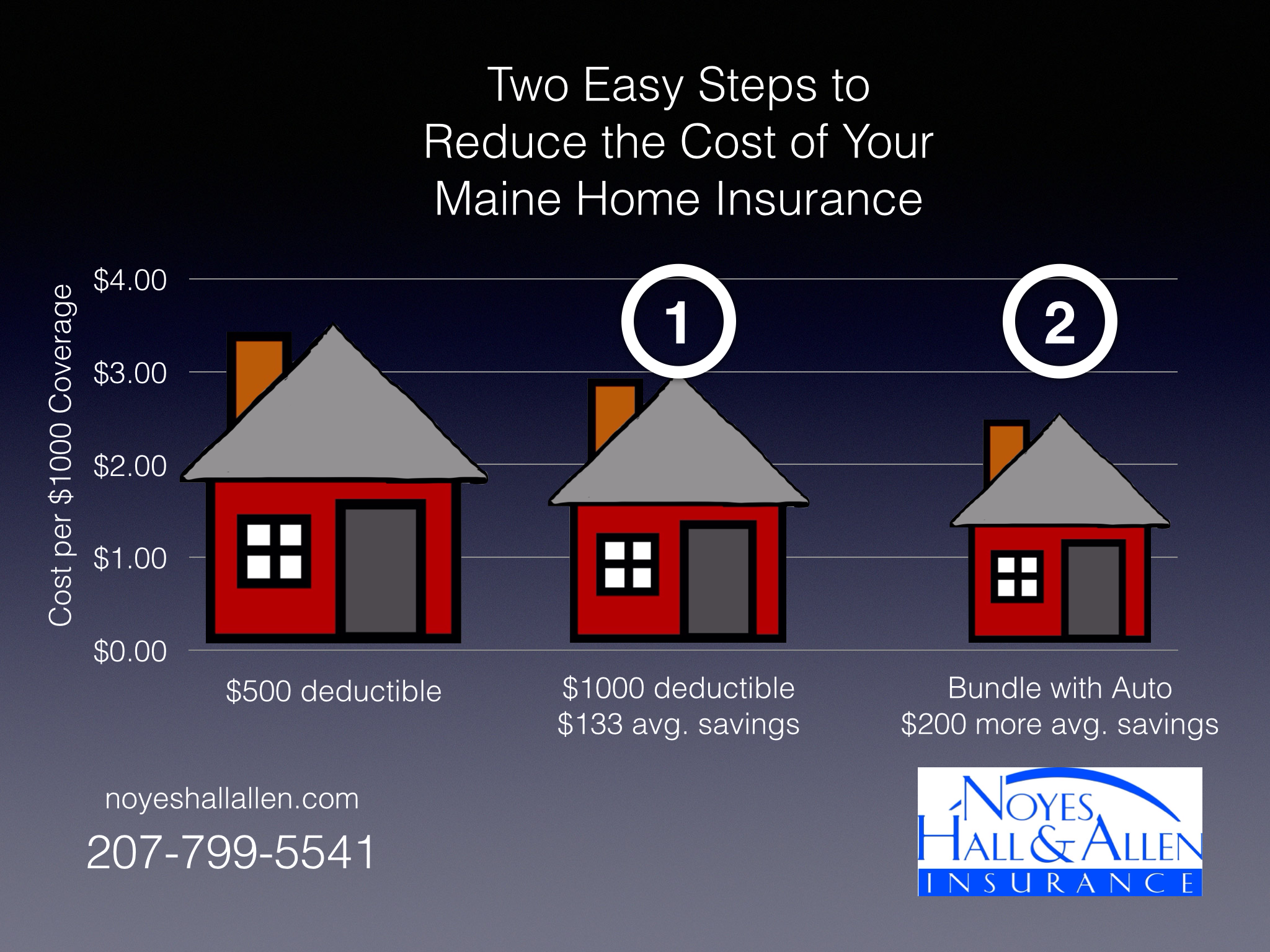

Most companies offer a discount on both auto and home policies (and sometimes other policies as well) as an incentive to policyholders. This has the potential to make both policies cheaper than if you were to purchase the policies from two separate insurance companies. To help give you an idea of how much you could potentially save by bundling policies, we checked each carrier’s website or contacted them to see how significant each company’s bundling discount could be. Not every California homeowner will be able to secure a cheap policy, particularly those in a high-risk wildfire area. In fact, homeowners with homes at elevated risk for wildfire damage may struggle to secure any insurance policy, let alone a cheap one. That said, getting familiar with the cheapest home insurance companies in California can be a good starting point if you’re looking for coverage on a budget.

Full list of best homeowners insurance in California

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Comparing quotes from top home insurance providers like Allstate, Chubb and State Farm may help you find the right carrier for your needs.

Best homeowners insurance in California for consumer experience: Nationwide

These carrier ratings are specific to home insurance — a company's rating for other products may be different on our website. When comparing rates in your best home insurance quotes, keep in mind that the average annual cost of home insurance is $1,754 for a policy with $300,000 in dwelling coverage. Most standard home insurance policies come with replacement cost dwelling coverage and actual cash value personal property coverage by default. Homeowners insurance protects against damage to your home and belongings from covered perils, and safeguards your assets if you're liable for someone else's injuries or property damage. Additionally, your homeowners policy may pay for an increase in living expenses if your home is uninhabitable due to a covered loss. Get a homeowners insurance quote online today and see how easily you can obtain customized coverage from Progressive.

Cheapest Homeowners Insurance Based on Dwelling Coverage

Common deductibles for home insurance are $500 and $1,000, but you can save by increasing your deductible. Aside from coverage amounts, you will also want to take a close look at the deductible, the policy type and whether your belongings are insured on an actual cash value or replacement cost value basis. These may seem like minor details but can have a major impact on what you wind up paying for your policy. Just because something is excluded from your home insurance policy does not mean you can’t be covered for it, though. Home insurance providers sell separate endorsements for earthquakes, floods and other perils to protect your home further.

While the definition of a high-value home may change from region to region, they have some insurance commonalities. Owners of high-value homes may seek higher coverage limits, specialized coverage endorsements and dependable customer service. When hearing that location can influence home insurance costs, many people’s minds jump to state-by-state cost considerations. While the state you live in plays a role in the cost of your insurance, so does your ZIP code. The interactive map below shows home insurance rates from across the state to help you compare. If you’re wondering why California’s home insurance rates are so low considering how risky the state is, it’s largely because of strict consumer protection laws.

Your home is one of your largest and most meaningful investments, so choosing the best homeowners insurance available to you makes sense. Naturally, you’ll want a good price — but you also want the right mix of coverage from a company that can afford to pay your claim if disaster strikes. Along with coverage limits, your home's location has a major impact on your home insurance rates. States with frequent hurricanes, wildfires, and other disasters often have higher average home insurance rates than those with more mild weather. Our proprietary rating methodology takes multiple factors into account, including customer satisfaction, cost, financial strength, and policy offerings.

Best Homeowners Insurance in Georgia of 2024 - MarketWatch

Best Homeowners Insurance in Georgia of 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Cheapest companies for homeowners insurance in each state

Complaints to state regulators about NJM’s homeowners insurance are far fewer than expected for a company of its size, according to the NAIC. Based on these factors, here are our top home insurance companies for 2024. However, most lenders will require proof of home insurance before you can close on a property. Allstate is one of the most popular home insurance providers in the country thanks to several customizable options, unique coverage add-ons like short-term rental coverage, and availability in all 50 states. In addition to deciding how much of each coverage you need, you should also look at how claim settlements are determined when comparing policies from different companies. Property Damage coverage protects against damage to your home and many permanent structures on your property.

Claims Center

You could even get a discount on an ADT system and other smart home devices if you’re an American Family policyholder. This company, however, isn’t available in all states, so your eligibility may vary. Yes, it’s worth your time to compare quotes even if you already have homeowners insurance. If you don’t, you could be missing out on savings for similar coverage with another insurance company. Progressive has the cheapest homeowners insurance at an average of $746 per year for $350,000 in dwelling coverage, among the companies we analyzed.

But if speed, value, and overall ease-of-use are your priorities, then we recommend getting home insurance quotes through our online marketplace at Policygenius. Simply click the Get free quotes button anywhere on this page to get started. Flood insurance is a separate policy with additional protection to a homeowners policy, protecting you from more severe types of water damage like heavy rain, melting snow, or severe coastal storms. Additional expenses could be covered for extra costs you might have to pay when experiencing a covered loss. For example, payment for a place to stay if your home suffers damage that makes it unlivable. If your house costs more or less to rebuild than our sample home, you might need a different amount of dwelling coverage.

If you purchased an investment property to rent out, you’ll likely need a home insurance provider that offers either short-term rental coverage or a landlord policy. A standard home insurance policy will likely only cover an owner-occupied building. Landlord insurance, among other things, can provide coverage for a tenant-occupied building. Short-term rental insurance can raise your liability limits and offer additional protection for your personal belongings.

This type of home insurance provides dwelling coverage, other structures coverage and personal property coverage, in addition to liability, medical payments and additional living expenses. Your dwelling and other structures are typically insured on an “open peril” basis, meaning they are protected from everything except what is specifically excluded as outlined in your policy. Your personal property, however, is only protected from the losses, or “perils,” that are named in your policy. QuoteWizard rated insurance companies based on their cost, discounts, coverages, financial strength, J.D. We used a weighted rating for each of these categories and scored them out of five. Although your home insurance rates depend on many factors, you can get affordable coverage for your home by comparing rates from different insurance companies.

You can then compare these with quotes for the same coverage types and limits from a few other carriers. Even if you already have a home insurance policy in place, you might consider shopping around on occasion to make sure you're getting the coverage and customer service you need at the best price. You might consider comparing quotes if your coverage needs have changed, you're not satisfied with the level of service with your current carrier or you think you could get a better rate for the same coverage. Many home insurers incentivize customer loyalty with a bundling discount.

No comments:

Post a Comment